About Us

Our Journey

NEBULATIQ was founded in 2018 by a group of financial technology experts and educators who recognized a growing digital divide in financial services across Ghana. Our founders, led by Dr. Kwame Osei, identified that while mobile banking and financial applications were rapidly expanding, many citizens lacked the knowledge to use these tools effectively and securely.

What began as informal workshops in community centers quickly grew into a structured educational initiative. Within our first year, we had trained over 500 individuals in basic digital financial literacy. By 2020, we established our permanent education center in Cape Coast and expanded our curriculum to cover advanced topics like automated savings, digital investment platforms, and cybersecurity for financial transactions.

Today, NEBULATIQ stands as Ghana's premier digital finance education provider, having helped over 10,000 individuals across all demographics navigate the increasingly complex world of digital finance. Our commitment to accessible, practical education has earned us partnerships with major financial institutions, government agencies, and international organizations focused on financial inclusion.

Our Mission & Values

Empowering financial literacy in the digital age

Our Mission

To bridge the digital finance literacy gap by providing accessible, practical education that empowers individuals to confidently manage their financial lives in the digital era. We believe that financial empowerment is a fundamental right, and that proper education about digital tools can transform financial outcomes for individuals and communities.

Our Values

- Accessibility: Making digital finance education available to all, regardless of prior knowledge or resources

- Practicality: Focusing on real-world applications rather than abstract concepts

- Security: Prioritizing safe practices in all aspects of digital finance

- Innovation: Continuously adapting our approaches to match evolving financial technologies

- Community: Building supportive networks for ongoing learning and growth

Meet Our Team

The experts behind our digital finance education programs

Dr. Kwame Osei

Founder & Executive Director

With over 15 years in financial technology and education, Kwame leads our strategic vision. He holds a PhD in Financial Economics from the University of Cape Town and previously worked with the Central Bank of Ghana.

Ama Mensah

Education Director

Ama oversees all educational programs and curriculum development. Her background in adult education and financial services has been instrumental in creating our accessible learning approach.

Emmanuel Darko

Cybersecurity Lead

Emmanuel ensures all our teachings incorporate the latest security best practices. His expertise in financial fraud prevention helps us equip students with critical protection skills.

Grace Addo

Community Outreach Coordinator

Grace leads our efforts to reach underserved communities. Her background in social work and passion for financial inclusion drives our mission to leave no one behind in the digital finance revolution.

Our Achievements

The impact we've made since 2018

Individuals Trained

Over ten thousand people from diverse backgrounds have completed our digital finance literacy programs, ranging from basic mobile banking to advanced investment applications.

Communities Reached

Our mobile training units have reached 42 different communities across Ghana, including remote rural areas where traditional banking services are limited or non-existent.

Financial Partners

We've established partnerships with 15 financial institutions, including banks, mobile money providers, and fintech startups, ensuring our curriculum stays current and practical.

Adoption Rate

85% of our program participants report regular use of at least two digital financial tools within three months of completing our training, compared to just 23% before enrollment.

Excellence Awards

Our work has been recognized with three national awards for innovation in financial education, including the prestigious Ghana Financial Inclusion Excellence Award in 2022.

Research Publications

Our team has contributed to 24 academic and industry publications on digital finance literacy, helping shape best practices in the field both nationally and internationally.

What People Say About Us

Hear from those who've experienced our programs

Before NEBULATIQ, I was losing money to transaction fees and struggling to keep track of my shop's finances. Their training showed me how to use digital tools that have transformed my business. I now manage inventory, track sales, and even offer digital payment options to my customers.

As a teacher, I was skeptical about mobile banking apps, fearing security issues. NEBULATIQ's educators were patient and thorough, showing me not just how to use these tools but how to do so safely. I've now set up automatic savings and bill payments that have completely simplified my financial life.

I never thought someone my age could understand these new financial technologies. The instructors at NEBULATIQ made everything simple and showed me how mobile money could help me receive payments for my crops without traveling to town. Now I even help other elders in my village use these services!

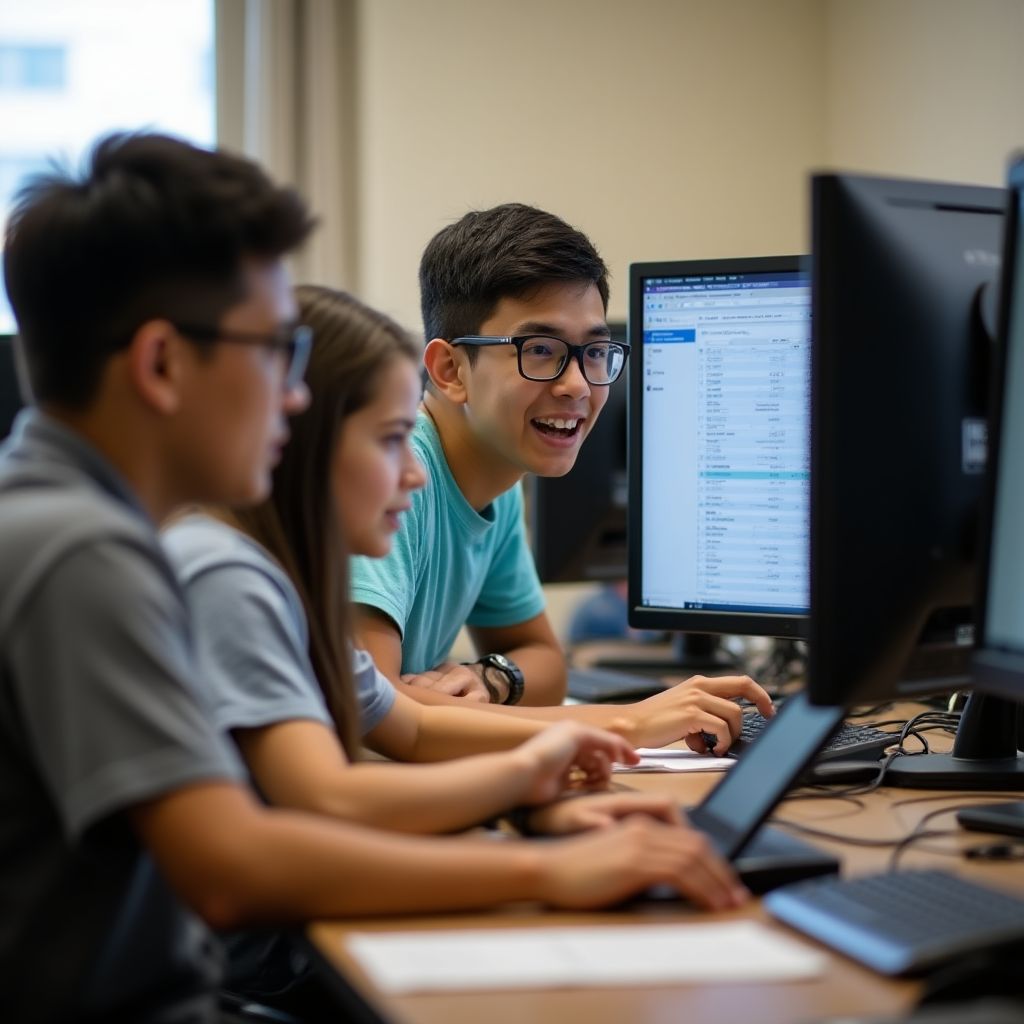

Our Work in Action

A glimpse into our educational activities

Ready to Transform Your Financial Future?

Join thousands of others who have enhanced their financial lives through our programs. Whether you're looking to learn basic mobile banking or advanced investment strategies, we have a program for you.