Digital Finance Literacy for the Modern World

Master financial apps, mobile banking, and secure digital transactions to take control of your personal finances.

About NEBULATIQ

Empowering financial literacy in the digital age

Our Mission

At NEBULATIQ, we're dedicated to bridging the digital finance literacy gap in Ghana and beyond. Founded in 2018, our organization has helped over 10,000 individuals navigate the complex world of digital finance. We believe that financial empowerment begins with education, which is why we've developed comprehensive programs that cater to all levels of financial understanding.

Our team of expert financial educators combines real-world experience with academic knowledge to deliver practical, accessible training. We focus on teaching essential skills such as mobile banking usage, secure digital transactions, personal finance automation, and cybersecurity awareness for financial applications.

Through our workshops, online courses, and community outreach programs, we're committed to creating a financially literate society where everyone can confidently manage their digital finances and secure their financial future.

Read More About UsOur Learning Process

A structured approach to mastering digital finance

Assessment

We begin with a comprehensive evaluation of your current digital finance knowledge and skills. This personalized assessment helps us understand your specific needs and goals, allowing us to tailor our approach to your learning journey.

Foundation Building

Next, we establish core knowledge about digital finance concepts, terminology, and basic tools. This foundation ensures you have the necessary background to build more advanced skills, regardless of your starting point.

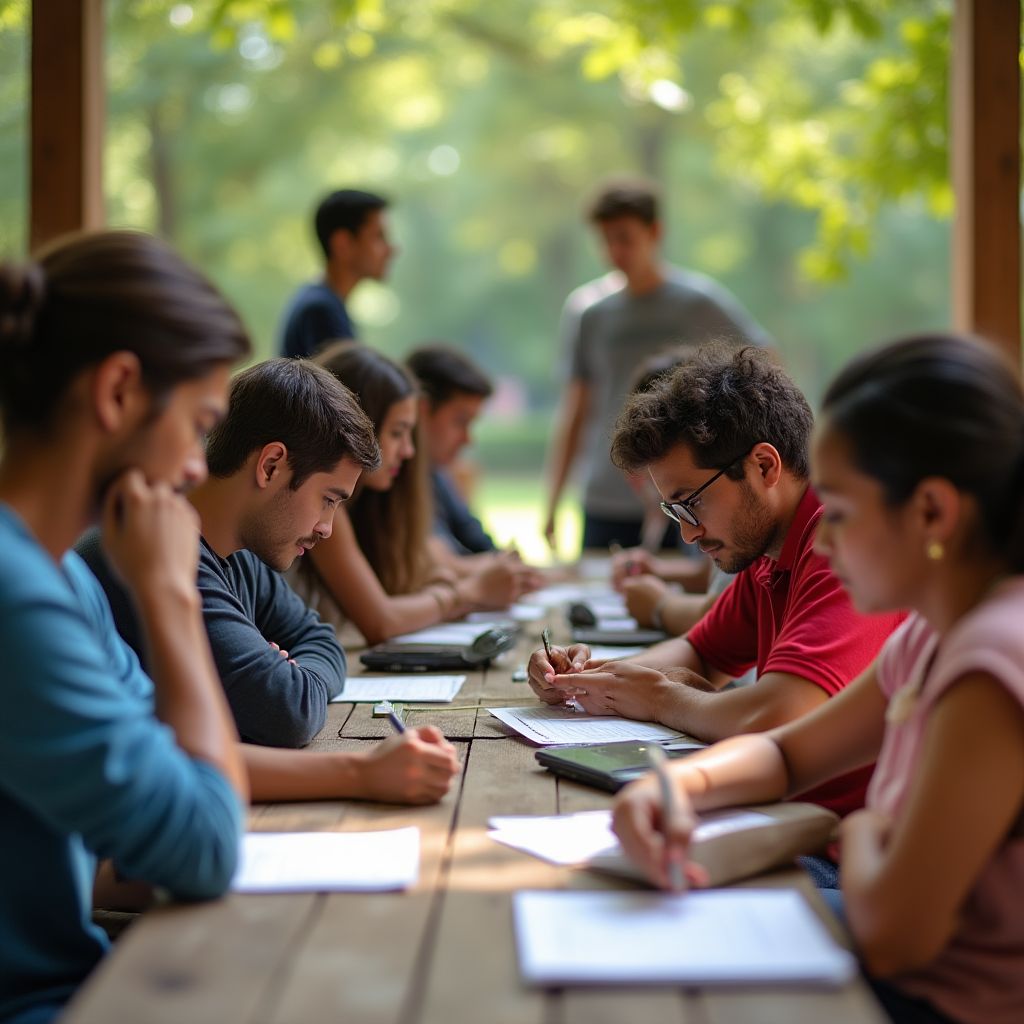

Practical Application

Through guided hands-on sessions, you'll apply what you've learned using real financial applications. Our practical approach ensures you gain confidence in using digital financial tools in a safe, supportive environment.

Mastery & Support

Finally, we help you master advanced concepts and provide ongoing support as you integrate these new skills into your daily financial management. Our community remains available for questions and continued learning.

Success Stories

Real-world transformations through digital finance literacy

Local Business Transformation

Kofi Mensah, a local shop owner in Cape Coast, struggled with cash management and inventory tracking. After completing our business-focused digital finance program, he implemented mobile banking and digital inventory systems that increased his revenue by 35% in just six months. His story demonstrates how proper digital tools can transform small businesses.

Read Full Story

Community Banking Initiative

A women's cooperative in rural Ghana faced challenges accessing traditional banking services. Through our community program, 45 women learned to use mobile banking apps, set up savings accounts, and establish digital payment systems for their products. The initiative resulted in a 50% increase in collective savings and opened new market opportunities through digital platforms.

Read Full Story

Youth Financial Empowerment

Our university partnership program introduced 200 students at Cape Coast University to digital finance tools, budgeting apps, and investment platforms. Post-program surveys showed that 85% of participants started using at least two digital finance tools regularly, and 60% established their first investment accounts. This early financial literacy is setting them up for long-term financial success.

Read Full StoryOur Research

Evidence-based approaches to digital finance education

Secure Digital Transactions

Our research team has conducted extensive studies on security vulnerabilities in mobile banking applications across Ghana. By identifying common threats and developing mitigation strategies, we've created security guidelines that have been adopted by three major financial institutions. Our findings revealed that simple user education could prevent up to 73% of common security breaches in digital finance.

This research continues to inform our curriculum development, ensuring that our students receive the most current security training available.

View Research Paper

Digital Finance Adoption Patterns

In collaboration with the University of Ghana, we've studied the factors influencing digital finance adoption across different demographic groups. Our research identified key barriers including language accessibility, technological intimidation, and concerns about fees. This data has been instrumental in developing targeted educational approaches for specific populations.

The resulting insights have helped us create specialized programs that have increased digital finance adoption by 45% among previously underserved communities.

View Research Paper

Financial Literacy Impact Study

Our longitudinal study tracking 500 program participants over two years demonstrated significant improvements in financial outcomes. Key findings include:

- 67% increase in regular savings

- 42% reduction in fees paid for financial services

- 89% reported greater confidence in financial decision-making

- 55% began using automated budgeting tools

This research validates our educational approach and continues to guide program refinements to maximize participant success.

Download Full StudyTrusted Resources

Additional tools and platforms to enhance your digital finance journey

Bank of Ghana Financial Literacy Portal

Official resources from Ghana's central bank on safe banking practices and regulations.

Visit Portal

Global Fintech Academy

Free courses on emerging financial technologies and their applications in daily life.

Explore Courses

Digital Finance Security Alliance

Stay updated on the latest security threats and protection strategies for digital finance.

Learn Security Best PracticesWhat Our Students Say

Real experiences from people who've transformed their financial lives

Upcoming Events

Join us for workshops, seminars, and community programs

Mobile Banking Essentials Workshop

A hands-on introduction to secure mobile banking applications. Learn to set up accounts, transfer funds, pay bills, and monitor transactions safely.

Location: NEBULATIQ Center, Cape Coast

Time: 10:00 AM - 2:00 PM

Register Now

Digital Investment Platforms Seminar

Discover how to start investing with as little as GH₵10 using accessible digital platforms. Covers risk assessment, diversification, and long-term strategy.

Location: Cape Coast University, Business School

Time: 4:00 PM - 6:30 PM

Register Now

Community Digital Finance Weekend

A free two-day program for underserved communities to learn essential digital finance skills. Includes mobile money management, secure practices, and basic budgeting.

Location: Elmina Community Center

Time: 9:00 AM - 3:00 PM (both days)

Register Now

Digital Tools for Small Business Owners

Specialized workshop for entrepreneurs to implement digital payment systems, inventory tracking, and automated financial reporting for small businesses.

Location: NEBULATIQ Center, Cape Coast

Time: 1:00 PM - 5:00 PM

Register NowOur Impact Projects

Initiatives that are transforming financial literacy across Ghana

Youth Financial Empowerment Program

Our flagship initiative introduces digital finance concepts to students aged 14-18 in 25 schools across Ghana. Through interactive learning modules and practical exercises, we've equipped over 3,000 young people with essential financial skills before they enter adulthood.

Rural Digital Banking Initiative

Bringing digital finance education to underserved rural communities through mobile training units. Our teams travel to remote areas with training equipment to teach essential digital banking skills, helping bridge the urban-rural financial literacy gap.

Seniors in the Digital Age

Specialized training program designed specifically for older adults to gain confidence in using digital financial tools. With patient instruction and simplified materials, we've helped seniors overcome technological barriers and embrace the convenience of digital finance.

Frequently Asked Questions

Common questions about our digital finance literacy programs

While having your own smartphone or tablet is helpful for practicing at home, it's not required for participation. We provide devices during all our workshops and training sessions. For those who don't have personal devices, we offer additional practice sessions where you can use our equipment until you feel comfortable with the digital tools.

Absolutely. During training, we use simulated banking environments and test accounts, so you never need to enter your actual financial information. We place the highest priority on privacy and security. All our teaching materials and practice environments are designed to provide realistic experience without risking your personal data.

Our programs are designed for all levels of technological experience, including complete beginners. We offer specialized "Digital Basics" courses that start with fundamental skills like touchscreen navigation and app installation before moving to financial applications. Our instructors are trained to provide patient, step-by-step guidance tailored to your comfort level with technology.

No, we offer our programs in multiple languages to ensure accessibility. While our standard programs are conducted in English, we regularly provide sessions in Twi, Fante, Ga, Ewe, and other local languages depending on the community we're serving. When registering, you can indicate your preferred language, and we'll do our best to accommodate your needs.

We offer a mix of free and paid programs. Our community outreach initiatives and basic workshops are typically free of charge, funded by our partners and sponsors. More comprehensive courses and specialized training programs have modest fees, with scholarships available for those who qualify. We're committed to making digital finance education accessible to everyone, regardless of financial circumstances.

Contact Us

Have questions? We're here to help!

Visit Our Center

9 Aboom Rd, Cape Coast, Ghana

Call Us

+233 33 213 6674

Email Us

info@nebulatiq.org

Office Hours

Monday - Friday: 8:00 AM - 5:00 PM

Saturday: 9:00 AM - 2:00 PM